Every few years, mankind stumbles upon a new technology, innovation, discovery, or idea that catapults humanity and changes the world as we know it. The most notable of these discoveries that come to mind would be the discovery of Penicillin by Alexander Fleming in 1928, the first sustained flight in an aircraft performed by the Wright brothers in 1903, the invention of the internet in 1983, and my personal favourite: Indoor plumbing, because well… Thank goodness for that luxury.

Obviously, as a Coin Bureau reader, there is no need for me to go into the details of the massively disruptive potential that Blockchain technology and cryptocurrencies in general have, and why many people feel that the decentralized finance movement could potentially be the greatest disruptive innovation of this century. And I am also sure that you are already quite aware of, and need no convincing about some of the incredible investment and generational wealth-building opportunities that only exist in the decentralized finance space, which is why you, as a savvy reader and early adopter of crypto, comes to the Coin Bureau in the first place. Though sometimes, as with any new innovation or technology, the learning curve can be steep when you are looking to get involved and take advantage of some of these new innovations but worry not! That is why I am here today to help you out with a guide on everything you need to know on how to get involved with Compound Finance.

Page Contents 👉 [hide]

Compound Finance in a Nutshell

As this is a “How-to” DIY tutorial, the history behind what Compound Finance is, and how it works is outside the scope of this article. If you want to learn more about Compound Finance first and get a handle on the ins and outs, we have a handy article that covers just that, which can be found here. Or, if you prefer video format, Guy also did a review on Compound Finance which you can find here.

Compound Finance Welcome Screen Outlining the Total Value of Assets currently Earning Interest Image via Compound Finance

Many Crypto enthusiasts choose to simply squirrel away, stash, and hold their crypto in software or hardware wallets and walk away until the time comes to swap or sell. Not that there is anything wrong with doing that, these HODLers are still allowing themselves the benefit of long term, capital appreciation of these assets. Though many DeFi lovers out there have chosen to take that a step further and have decided that while they are holding onto these absolute crypto gems long-term, why not also lend them out to borrowers and earn interest? This is like adding rocket fuel to their investments as they are not only benefitting from the mouth-watering capital appreciation of their crypto-assets that we have all come to know and love, but they are also earning interest on top of that. Win-Win!

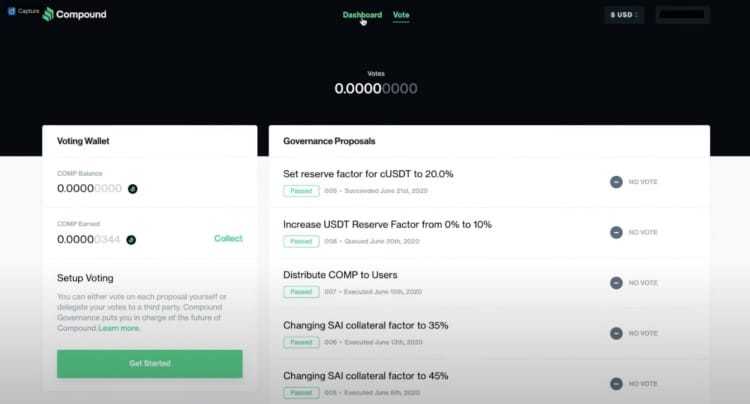

Before getting into the nuts and bolts of how to get involved, it is important to discuss and understand Compound Interest’s native governance token COMP, and its functions and purpose. Compound (COMP) is an Ethereum (ERC20) token that enables community governance of the Compound protocol. It is important to note that Compound Finance is a completely decentralized protocol, meaning there is no team, company, or group outside of the community of users that have control or say over how the protocol should be run. Unlike your bank who has the authority to lock you out of your accounts, dictate where you can, or cannot spend your money, or whether you can, or cannot borrow, Compound Finance is run by its community members, normal folks such as you and I who hold the Comp token which is accessible to anyone. Holders of Comp tokens give users the right to vote on new proposals brought forward by the community, so it is the users who have a vested interest in Compound Finance who get to govern how the protocol should be run. A true protocol by the people, for the people. As Compound Finance is truly decentralized, there is also no need for any form of KYC, nor ID verification needed to get started.

How to Lend and Earn APY

Interest Increasing

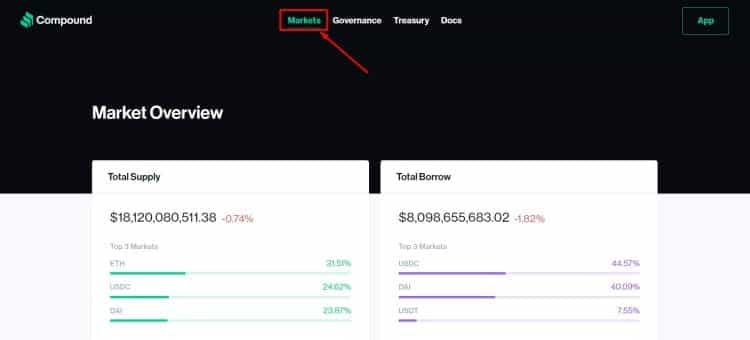

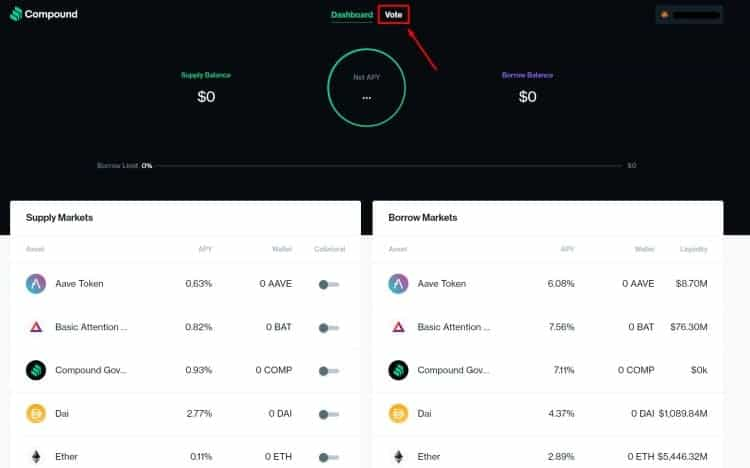

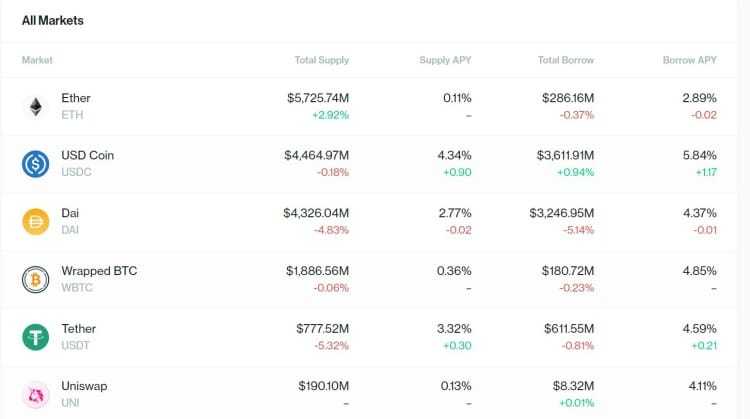

To get started, the first thing you are going to need to do is hold the amount of the token that you are going to want to lend out. Understandably, you cannot lend out what you don’t hold. For a full list of assets that are currently supported, and their APY’s you can check out the Compound Finance Markets page

Supported Assets and APY Shown, Image via Compound Finance Market Page

Once you have found the asset that you want to lend out, the first thing to do is acquire that asset using your favourite exchange, if you do not already have a “go-to” exchange, here is an video where we cover some of the top, and safest exchanges that we recommend.

Okay, now you’ve made your crypto purchase, Yahoo! Time to Giddy-up and get involved in the rootin-tootin world of DeFi right? Hold your horses there cowboys and cowgirls, first, we need a way to interact with the Compound Finance Protocol. If you have made your purchase on a centralized exchange, chances are that the exchange where you bought, and now hold your crypto, isn’t going to want to play nice with the decentralized world of crypto lending where the exchange isn’t making any money. So, it looks like your assets are going to have to hit the old dusty trail and ride off into the sunset away from the exchange and to the next watering hole to a decentralized wallet where DeFi can flourish.

What am I talking about? Well, to interact with the Compound Finance protocol you are going to have to link a decentralized Ethereum wallet, such as the Coinbase wallet, Ledger hardware wallet, or the most popular, and commonly used Metamask wallet.

If you don’t already have an Ethereum wallet, you can find tutorials here on how to set up Metamask , Coinbase wallet, how to use wallet connect or use Ledger with Compound Finance.

Once you have your Ethereum wallet setup, with the assets that you want to lend out and some Ethereum held in that wallet to cover the Ethereum gas fees that will be charged to use the Compound Finance protocol, the Compound Finance site will automatically prompt you to connect your wallet.

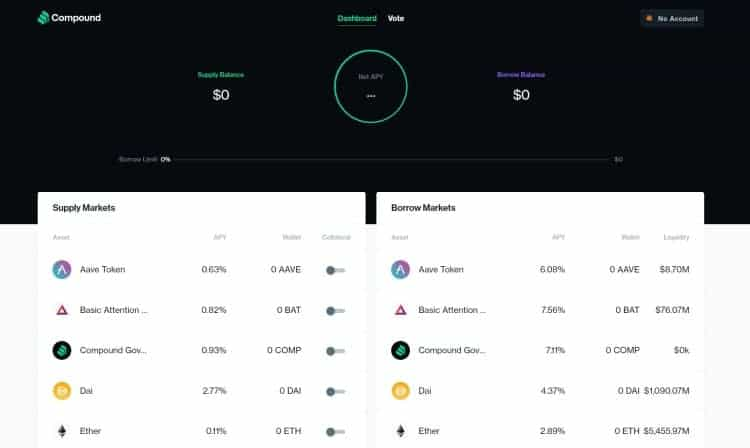

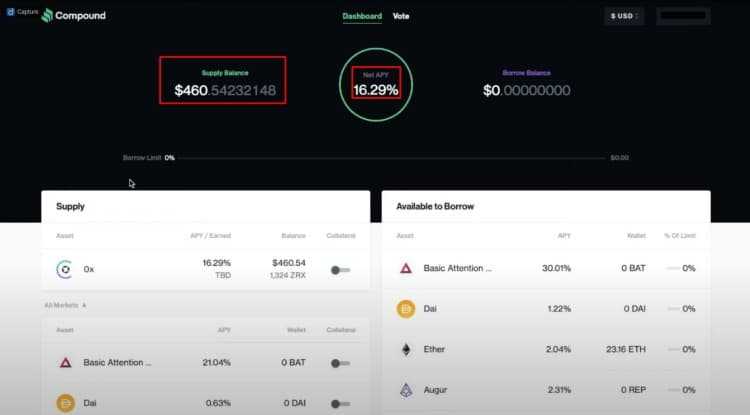

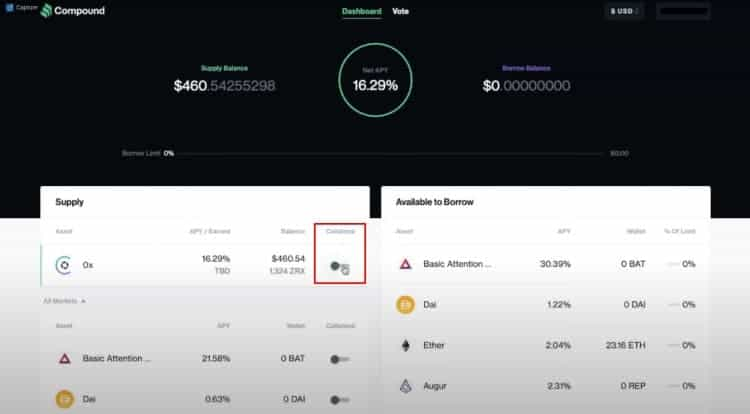

From there you will be taken to a user-friendly, and easy to interact with dashboard where you will easily be able to choose which assets you either want to lend on the left, or borrow on the right.

Compound Finance Lending and Borrowing Dashboard

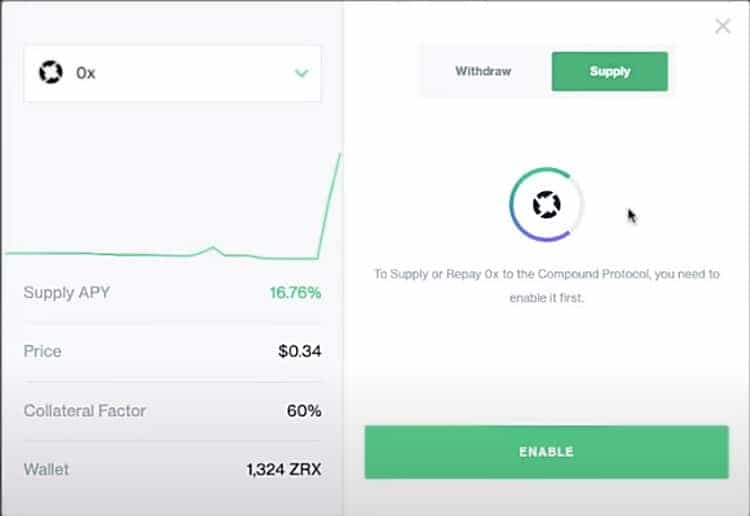

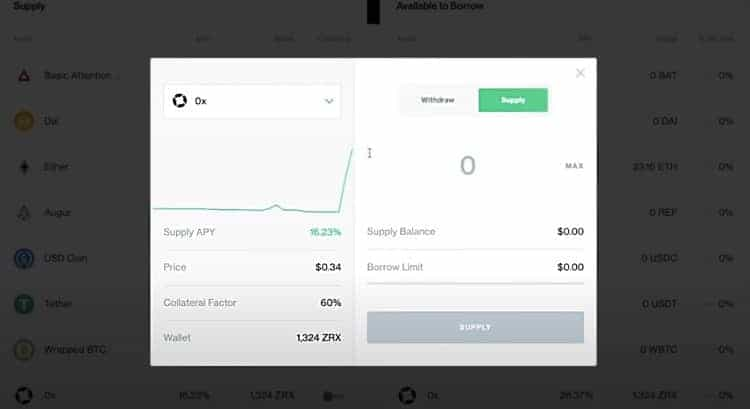

Say you are holding some 0x and you want to lend it out, you would click on the asset and be met with a popup screen where you can choose to “supply” the asset which means lending it out.

Compound Finance 0x Supply Screen showing the APY, Price, Collateral Factor and 0x Amount Held in the User’s Wallet

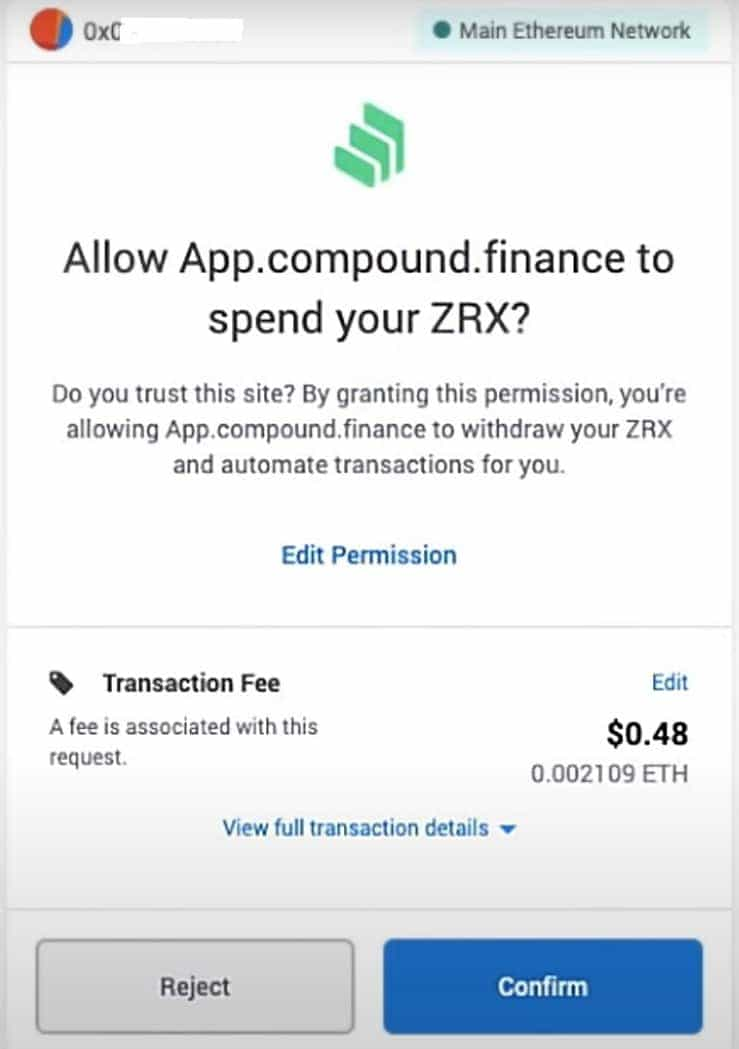

You will need to select to “Enable” the asset if this is your first time lending that particular asset out. This will open a new tab that will take you to your wallet screen, as your wallet will need to wait for you to authorize Compound Finance to be able to interact with your Ethereum wallet balance, and for you to confirm the Ethereum gas fee.

Metamask Popup Asking for Authorization to Interact with Compound Finance

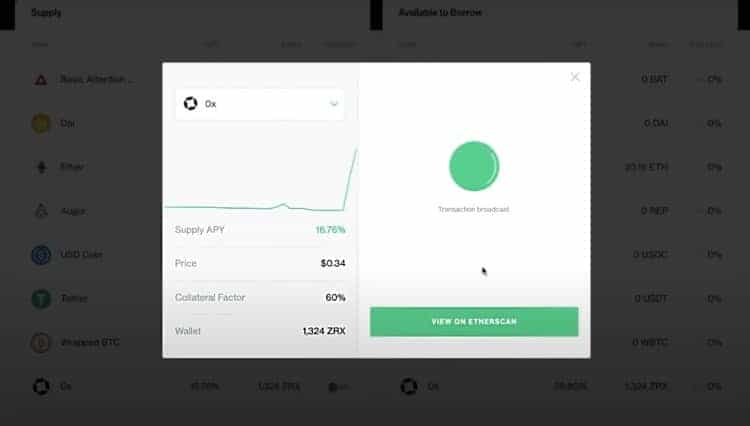

On this screen, you will be able to adjust or accept the gas fee that is required to perform this transaction. Once you hit confirm, your Ethereum wallet has now initiated the transaction needed to interact with the Compound Finance protocol. Now you will be taken to a broadcast screen where you will need to wait for the transaction to clear. The wait time is dependent on the congestion of the Ethereum network and the gas fee selected, but normal transactions should clear in around five minutes, sometimes longer if the network is experiencing high congestion or if too low of a gas fee was selected.

Transaction Broadcast screen shown as the Transaction is Pending

Now that the asset 0x has been enabled, and the transaction is cleared, you can now supply your 0x tokens. You will need to enter the amount that you want to supply, or hit “max” if you want to supply the whole balance baller style, then simply hit “supply”

Asset Amount Supply Screen

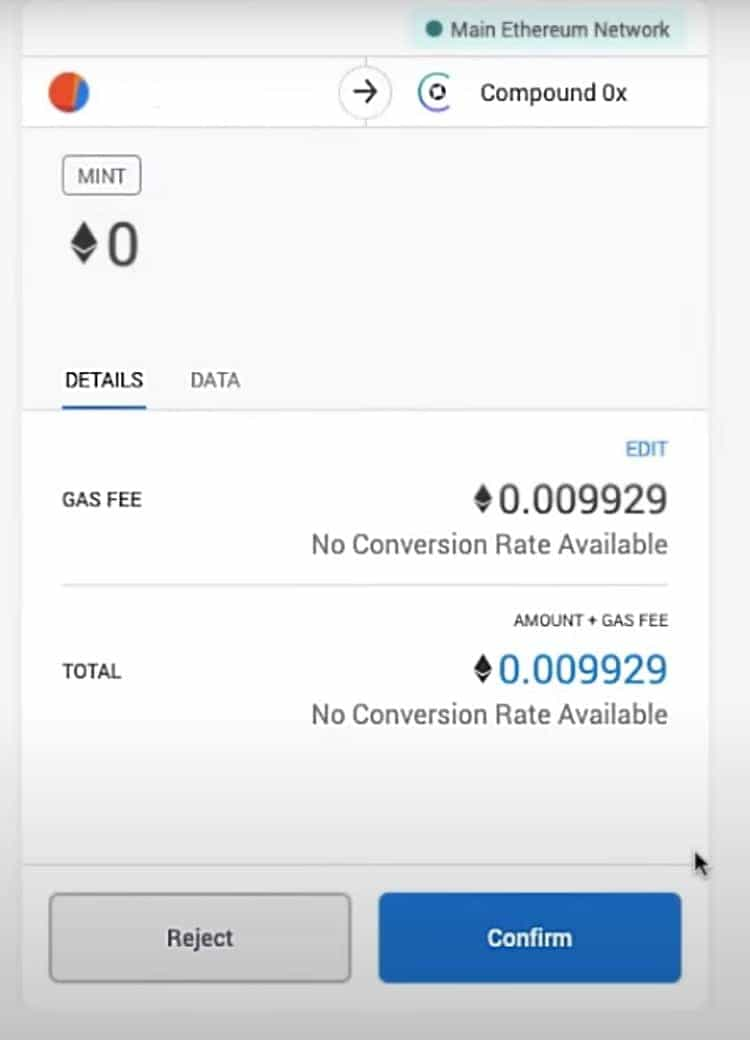

Hitting the supply button will once again prompt a popup for your Ethereum wallet where you will need to again confirm this transaction and choose or confirm the Ethereum gas fee that will be charged to perform this transaction.

Popup Redirect to Wallet Screen to Confirm Transaction and Edit or Select Ethereum Gas Fee

Well done! You have now supplied your first asset for lending and will start earning interest. Lenders earn Interest roughly every 15 seconds, about the time it takes for each newly Ethereum block to be mined. There is no minimum for lending or borrowing, this protocol can be used for as long as users like, with no penalty for withdrawing. Now that you have lent your first asset, you can return back to the dashboard where you can see the total balance that you have supplied and the net APY across the assets that you have lent out.

Compound Finance Dashboard Showing the Amount Supplied, or “Lent,” and the Net APY

You can simply click on the lent-out asset again and choose to “withdraw” from the lending pool at any time you like. When you lend your tokens, you will also be earning Compound (COMP) tokens, and your Comp balance can be found under the “vote tab”.

Vote Tab Where Users can find their Comp Token Balance and set up Voting

Comp tokens are distributed to lenders and borrowers proportionately depending on how much interest is being paid to each market. It is up to you what you want to do with these earned Comp tokens. They can be held long term for the potential of asset appreciation, this also allows for voting rights on proposals regarding the Compound Finance protocol, or you can sell them on a Dex such as Uniswap.

And that is it for lending, enjoy those sweet interest rates and good job in sticking with me so far. Now, let’s get into the other feature of Compound Finance and that is borrowing.

How to Borrow Funds

Are banks getting you down? Did you get denied financing for some arbitrary reason like you were only able to provide five and a half months of payslips instead of six? Maybe you forgot to pay that twenty dollar parking ticket ten years ago, or your ID has expired and now Mr Bank person is telling you that you don’t qualify for borrowing. Or maybe, you are one of the “fortunate” ones that the bank is happy to “help out” offering you a credit product for 19.99% interest, oh please….

Did I mention that Compound Finance allows users to borrow, open to anyone with no KYC, no credit checks, and most certainly, lower interest rates on average than most banks are willing to offer? Borrowing with Compound Finance is a great way to avoid having to sell your precious crypto moon-bags to cover those pesky expenses that can creep up. Or maybe you’re looking to borrow as the interest rates are low enough for you to justify treating yourself to something shiny, or you want to take yourself on that much deserved holiday. Perhaps you are a true DeFi degenerate and you want to ape “all in” into the next hottest crypto token that you don’t want to miss out on. For whatever the reason, Compound Finance offers a very convenient way to get started borrowing capital quickly and easily.

Lending APY and Borrowing Rates Shown on Compound Finance Markets Page

In order to get started with borrowing, you will still need to follow the steps outlined in the first part of the “How to Lend” section as you will still need an Ethereum wallet such as Metamask, connect that wallet to the Compound Finance app, and you will need to send some funds to that wallet to put up as collateral, as well as some Ethereum to cover the Ethereum network gas fees.

By being able to use your own crypto assets as collateral, that means you can still hold onto your crypto assets without having to liquidate them to get the cash needed for your expenses. Once you have your wallet connected to Compound Finance, and the funds sent to that wallet that you want to use for collateral, all you need to do is simply enable the collateral feature beside the associated asset.

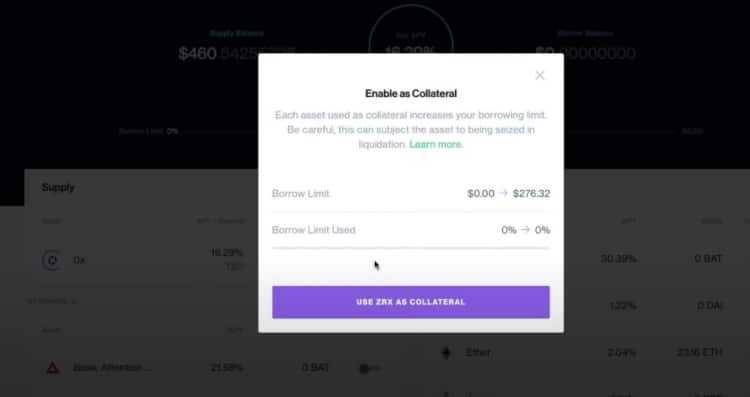

Enabling Collateral Option From the Compound Finance Dashboard

Clicking the collateral slider to the “on” position will prompt a popup where you are shown a warning screen with a “learn more” button that explains that assets put up as collateral are subject to liquidation risk should the borrower not pay back the borrowed funds, and the user is asked to confirm if they want to use these funds as collateral.

Confirmation Popup Explaining Liquidation Risk and Asking the User for Confirmation

Clicking the “Use *Asset name* as collateral” button will again take you to your wallet screen where you are asked to select the gas fee and accept the transaction.

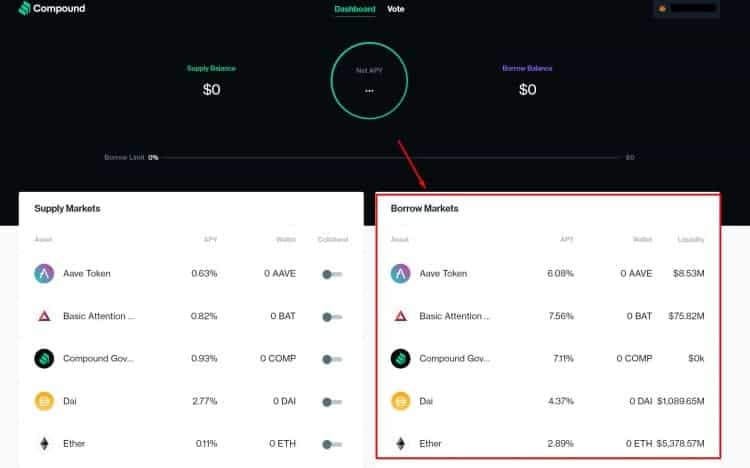

Once your asset is up for collateral, you can now navigate to the right-hand side of the dashboard and select the asset that you would like to borrow.

Selection of Assets Available to Borrow

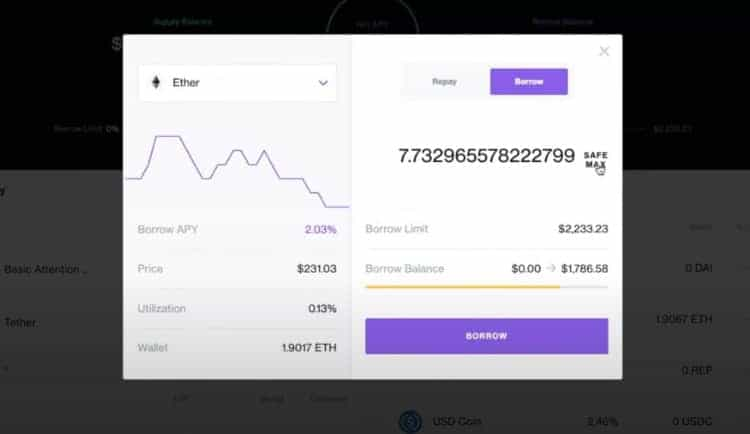

Once you have decided which asset you would like to borrow, simply click on the asset and a popup will come up asking how much you would like to borrow, and give you the option for a recommended “safe max” amount.

Popup for the Selected Asset the User Wishes to Borrow

The “Borrow Balance” section on the bottom shows the risk associated with the amount you are borrowing based on the amount of collateral you have provided.

Conclusion

And there you have it, you have now borrowed crypto assets that you can simply hold if you feel the price of that asset is going to appreciate more than the amount of interest you will pay, trade that borrowed asset for another asset or send it to an exchange where you can liquidate it for fiat to withdraw into your bank account and cover some expenses.

Everything shown in this tutorial can be done within an hour if you are already set up with a decentralized wallet and exchange. If you are starting this whole process from the start, you will still likely be able to be a lending and borrowing wizard within a day. This sure beats all the red tape, restrictions, and painfully slow processing times traditionally offered by your bank, not to mention you can also earn better interest rates through Compound Finance than your bank is willing to offer, and you can borrow for a less painful repayment interest rate. When you do a side by side, pro and con comparison, it isn’t even a contest. Lending platforms such as Compound Finance win hands down over the traditional banking method, and this is part of the reason why we are seeing many banks and institutions either trying to lobby against Crypto, or looking to implement it themselves and adopt this disruptive technology because as the saying goes, “If you can’t beat them, join them,” and that is what many banks are looking to do now as they see the decades of their free ride on the gravy train coming to an end. Decentralized, peer to peer lending platforms brings us closer to the end of banks being able to take gross advantage of people by making billions of dollars off the backs of regular people like us.